1

192-3203

UNITED STATES OF AMERICA

BEFORE THE FEDERAL TRADE COMMISSION

COMMISSIONERS: Lina M. Khan, Chair

Rebecca Kelly Slaughter

Christine S. Wilson

Alvaro M. Bedoya

________________________________________________

In the Matter of

EPIC GAMES, INC., a corporation.

DOCKET NO. C-4790

________________________________________________

COMPLAINT

The Federal Trade Commission, having reason to believe that Epic Games, Inc., a

corporation (“Respondent” or “Epic”), has violated the provisions of the Federal Trade

Commission Act, and it appearing to the Commission that this proceeding is in the public

interest, alleges:

Summary of Case

1. Epic is the developer and distributor of the hit video game Fortnite, which is

popular among kids. Though Fortnite itself is free to download and play, Epic charges consumers

for certain in-game items, such as costumes, dance moves, and item-filled piñatas shaped like

llamas. The problem: in many cases, Epic – employing myriad design tricks known as “dark

patterns” – has charged consumers for such items without first obtaining their express informed

consent, and then has banned consumers from accessing previously paid-for content when they

have disputed unauthorized charges with their credit card providers.

2. Millions of consumers have complained to Epic about these unfair practices and

disputed Epic’s unauthorized charges with their credit card providers. Epic’s own employees

also have repeatedly raised concerns about these practices and recommended measures to

address them. Yet despite consumers’ repeated complaints and employees’ concerns, Epic has

persisted in its unlawful conduct.

Respondent

3. Respondent Epic Games, Inc. is a Maryland corporation with its principal office

or place of business at 620 Crossroads Blvd., Cary, North Carolina 27518.

2

4. Respondent has advertised, marketed, offered for sale, sold, and distributed

products to consumers, including the video game Fortnite and Fortnite-related digital content.

5. The acts and practices of Respondent alleged in this Complaint have been in or

affecting commerce, as “commerce” is defined in Section 4 of the Federal Trade Commission

Act.

Epic’s Business Activities

6. Epic is the developer of the video game Fortnite, which is available on multiple

platforms, including Sony PlayStation, Microsoft Xbox, and Nintendo Switch game consoles,

mobile devices with Google Android, and personal computers (“PCs”) with Windows operating

systems. Fortnite has previously been available on Apple iOS (mobile devices) and Mac OS

(PCs) operating systems. Launched in July 2017, Fortnite has more than 400 million registered

users, many of whom are children or the parents of children who use Fortnite.

7. Epic also built and runs the Epic Games Store, an online video game store

through which it distributes Fortnite and other video games developed by third parties to PC

users.

8. Fortnite is free to download, though Epic also sells a premium version of the

game that costs money to download.

9. At the time of Fortnite’s launch, when consumers first made a purchase through

Epic – for example, of any video game – Epic saved consumers’ payment information by default

and used it to bill consumers for future charges, including charges incurred by children while

playing Fortnite or other games. Many consumers did not realize that Epic had saved their cards.

Downloading Fortnite from the Epic Games Store

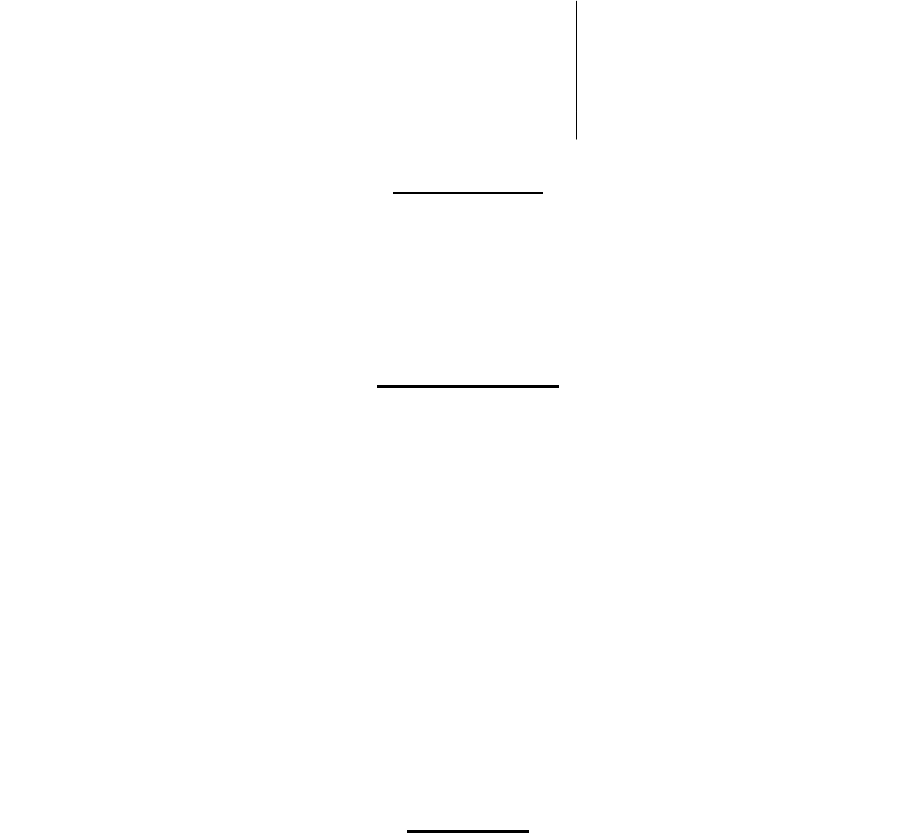

10. Account holders can download Fortnite by visiting the Epic Games Store and

searching for the game by name or browsing the various categories within the store. At times,

Fortnite has appeared under the categories “Most Popular” and “Free to Play.” Epic displays

search results or the contents of a category in rows of icons. Below each icon is the title and price

of the game. The price listed for Fortnite is “Free.”

11. Below is a screenshot of what consumers have seen after clicking on the Fortnite

icon on a personal computer.

3

12. Next to a brief description of the game is a yellow “GET” button to initiate

installation. Above the box, Epic reminds consumers that Fortnite is “Free.”

13. If the account holder had scrolled down the page, they could have viewed the full

game description, the game’s age rating, and other information. At the very bottom of the page,

and “below the fold” (meaning that the account holder would not have seen it without scrolling

down), was a small white box containing the game’s age rating. Below the age rating, in tiny

font, was text stating “In-Game Purchases/Users Interact.” Epic did not provide any further

information about how or when it seeks account holder authorization for in-game charges. See

Exhibit 1.

14. More than three years after it began billing for in-game charges, Epic began

including this box nearer the top of the page, but still under the “GET” button. The download

page still does not explain how or when Epic seeks account holder authorization for in-game

charges. See Exhibit 2.

Epic Has Charged Parents and Other Account Holders Without Authorization

15. The consumers who create Epic accounts and download Fortnite include parents

who download Fortnite so that their kids can play the game.

16. Once Fortnite has been downloaded, kids can compete against other players in

head-to-head battles, complete missions and objectives, or develop their own mini-games and

build custom structures. Kids also can customize a character’s appearance with different outfits,

emotes (i.e., dance moves), and gliders (collectively, “Cosmetics”), use “Battle Passes” to unlock

4

additional in-game content (such as missions or Cosmetics), or in the premium version of the

game, obtain piñatas shaped like llamas that are filled with various items (“Llamas”).

17. To obtain Cosmetics, Battle Passes, and Llamas, kids use “V-Bucks.” For more

than a year after Epic began offering in-app purchases, kids could acquire V-Bucks simply by

pressing buttons with no parental or card holder action or consent. At that point, Epic

automatically billed the parents’ stored payment information for the V-Bucks. Epic did not

require parents to enter a PIN or password to authorize V-bucks purchases, or even allow them to

enable such a control.

18. Epic began and persisted engaging in these practices despite prior public law

enforcement actions against Amazon, Apple, and Google for failing to obtain parents’ consent to

charges in kids’ gaming apps. See, e.g., Complaint at 7-8, FTC v. Amazon.com, Inc., No. 2:14-

cv-01038 (W.D. Wash. July 10, 2014); FTC v. Amazon.com, Inc., No. C14-1038-JCC, 2016 WL

10654030, at *11 (W.D. Wash. July 22, 2016) (finding Amazon liable under Section 5 of the

FTC Act); Complaint at 4-5, In re Apple, Inc., No. C-4444 (Mar. 25, 2014); Complaint at 6-7, In

re Google, Inc., No. C-4499 (Dec. 2, 2014).

19. Many parents have been surprised to learn that Epic charged them hundreds of

dollars for kids’ in-app activities that they did not authorize. For example, one parent complained

to Epic:

Hello Epic Games, The charges associated with this account were made without

my authorization. This account is associated with my 10 year old son’s account and

I am really disappointed that there is no check and balances that alerted me of these

charges, and a 10 year old can purchase coins worth almost $500 so easily.

20. Another parent complained about authorizing a one-time purchase, but then

being billed by Epic for additional charges without consent:

Epic Games is swindling parents with unauthorized game purchases, tricking young

consumers & using shady practices for billing. I authorized a 1-time Epic Games

purchase for my 11 yr-old son, only to discover EG did NOT erase my credit card

info, & thus my son has been making unauthorized purchases, racking up $140 in

less than 8 days after the initial authorized purchase.

21. In fact, according to company documents, “Unrecognized and Fraudulent

Charges” – a category that includes unapproved kid charges – was among the top five reasons

consumers complained to Epic.

22. Epic employees also raised concerns about unauthorized kid charges and

recommended measures to address them. For example, in June 2018, Epic employees discussed

plans to give account holders the option not to save their credit card information. As an Epic

5

Senior Producer acknowledged, “[m]any people … didn’t even realize it [their credit card] was

saved.”

23. In reply, Epic’s Fraud and Risk Consultant added that the “goal” of the feature

was to “mak[e] sure the parent doesn’t have to store the card so we can prevent some of the

unapproved kid purchases / friendly fraud.” However, Epic did not give consumers the option

not to have their payment information saved by Epic until October 2018.

24. Even then, Epic only added a small checkbox to the checkout page with the small

print, “Make this a one-time payment. Don’t save my credit card.” If consumers failed to notice

and check the box prior to completing the transaction, Epic saved their payment information and

automatically billed them for future purchases. Further, Epic still did not inform account holders

that Epic would automatically bill their saved credit card for future charges. And it was aware

that “typically the behavior [was] not to check this box[.]”

25. Epic’s Fraud and Risk Consultant also recommended in June 2018 that Epic begin

requiring account holders with saved credit cards to confirm their CVV numbers before charging

them. According to his email, “This is standard / best practice and it prevents kids from using

mom’s credit card without her permission[.]” However, Epic did not begin requiring cardholders

to re-enter their credit card CVV numbers for most transactions before charging them until

November 2018. By then, Epic had billed account holders for more than 200 million V-Bucks

charges (totaling more than $4 billion), many of them unauthorized.

Epic Has Billed Users for Unauthorized Digital Currency Charges

26. In addition to charging parents and other account holders without authorization

for kids’ in-app activities, Epic has designed its in-game purchase flows in a way that makes it

easy for users of all ages to incur unwanted charges.

27. Take the purchase flow for Cosmetics. Users can browse and view Cosmetic

items in the Fortnite Item Shop. If a user selects a particular item, Epic presents them with

various options, including the option to purchase the item, play the dance again, preview

different outfit styles, or go back to the Item Shop.

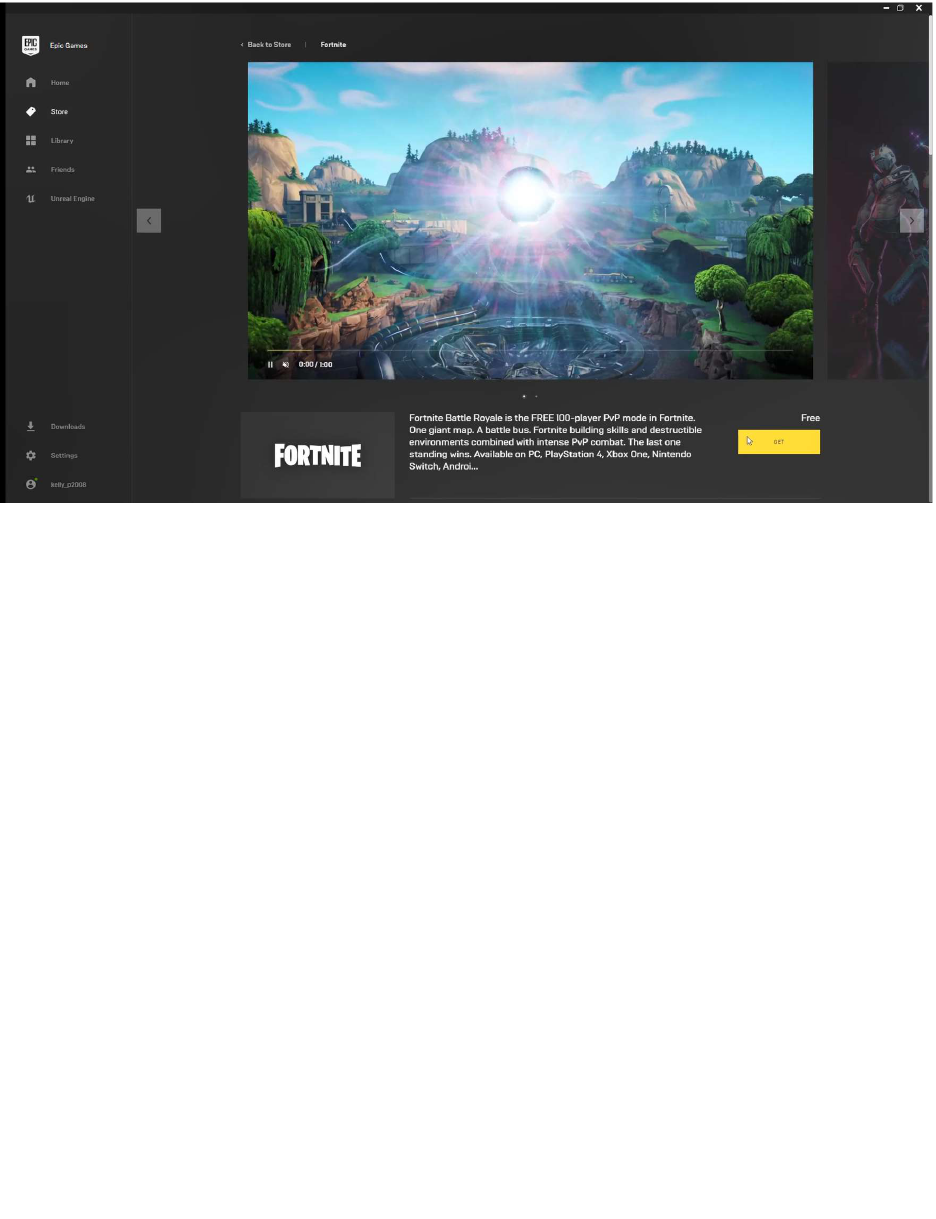

28. On mobile devices, the button to preview different outfit styles appears directly

below the button to purchase items, as shown in the screen capture below. To preview styles,

players must tap the button labeled “PREVIEW STYLES” with their finger. But if in the process

a player instead taps the adjacent button labeled “PURCHASE,” Epic immediately deducts the

cost of the item from the player’s V-Bucks balance.

6

29. On video game controllers, the button to purchase items is located immediately

adjacent to the buttons for other common in-game actions. For example, on the standard

PlayStation controller (pictured below), the button to purchase an item (‘Square’ or ) is

located next to the buttons to take other common actions, such as to play a dance move again

(‘Triangle’ or ), go back to the previous screen (‘Circle’ or ), or preview different outfit

styles (‘Cross’ or ), all of which are pressed using the same thumb. If while browsing an item

players accidentally bump the ‘Square’ button with their thumb, Epic immediately deducts the

price of the item from their V-Bucks balance.

7

30. The button to purchase items on video game consoles is also the same as the

button associated with other actions that do not result in the user incurring a charge. For

example, the square button is used to change the style of an already purchased outfit in the

Fortnite Locker. If a player wishes to preview different styles in the Item Shop and uses the same

button the player would use to change styles in the Locker, Epic immediately deducts the cost of

the item from the player’s V-Bucks balance.

31. In none of the scenarios just described does Epic require users to take any further

action before charging them, such as asking them to confirm their purchase. By contrast, as

discussed below, Epic requires users to press and hold a button in order to cancel unwanted

charges and to confirm their request for a refund.

32. Players similarly can incur unwanted charges while browsing Battle Passes. For

example, on PlayStation consoles, the button to purchase Cosmetics is ‘Square’ and the button to

preview styles is ‘Cross.’ However, these buttons are inverted for Battle Passes. The button to

purchase a Battle Pass is ‘Cross’ and the button to get more information is ‘Square.’ Prior to June

2020, if a user wanted to get more information about a Battle Pass before purchasing it but

clicked ‘Cross’ instead of ‘Square,’ Epic immediately deducted the cost of the pass from the

player’s V-Bucks balance. It did not require users to take any further action before charging

them, such as asking them to confirm the purchase.

33. Numerous users have incurred unwanted charges from Epic while browsing items

in Fortnite. Indeed, as an Epic Player Support representative acknowledged in an email to a

consumer, “It is very common to make an accidental purchase!”

34. Epic has received more than one million complaints from consumers related to

such unwanted charges. The following complaints are representative:

“We are really disappointed that you are unable to help us as we feel my Sons V Buck

accidental spend would have been avoided if your systems had more confirmation steps

before buying items. Most other games companies have clear steps before you can

purchase, e.g. item goes into basket, then questions asking ‘are you sure you want to

purchase this?’, ‘Press this button to complete your purchase’. Your purchase process has

none of these steps and we believe that it’s designed to take advantage of young users and

accidental purchase.”

“I’d like to raise a concern I have with the in-game store - there is no ‘confirm purchase’

button when you go to buy a skin/glider/axe….The reason I say this is because about 2

months ago I accidentally misclicked ‘purchase’ on a glider I had no intentions of buying.

It instantly just took the V-Bucks and that was that….”

“As you know today the vintage Skull Trooper skin got released and was excited to buy

it, however when I was flipping through the item shop I noticed the new Skull Sickle. I

wanted to look at the different colors that were offered with this harvesting tool and

instead of pressing ‘A’ to ‘Preview Styles’, I clicked ‘X’ and it automatically bought the

8

pickax!!! There should be an extra step when buying things from the item shop because

everything happened so fast. I would like a refund because I was going to use those extra

V-Bucks for a different Halloween skin that hasn’t been released yet.”

“This was an accident made by a 9 year old, who immediately said, ‘Oh no Dad, I clicked

the wrong button.’ But because of your One-Click purchasing, and no ability to turn on

purchase confirmation or parental blocks for the item store, and a little promoted

unobtrusive limited time button to cancel, you are going to say that we are stuck with it.”

“I accidentally purchased a skin using my V-Bucks when I just meant to rotate it and

check it out. Fat-fingered the ‘Square’ button on the PS4.”

35. Epic’s employees also have raised concerns about unwanted charges and

repeatedly recommended measures to address them.

In Spring 2018, Epic executives and managers discussed adding a confirm purchase

button to prevent accidental purchases. Though employees were concerned that “it is a bit

of a dark UX [user experience] pattern to not have confirmation on (once you hit [the

refund] limit) ‘destructive’ actions,” Epic feared that adding a confirmation button would

add “friction,” “result in a decent number of people second guessing their purchase,” and

reduce the number of “impulse purchases.”

On May 4, 2018, an Epic UX designer working on the refund feature recommended that

Epic “also implement a split-second ‘Hold to Purchase’ mechanic when buying an

item[,]” which he believed “would reduce accidental purchases without adding friction.”

On June 23, 2018, Epic’s Director of Player Support circulated a Player Support Status

Update that included a list of “Top Ticket Issues.” Number four on the list is: “Accidental

Purchase Claims - (around 6-7%) players are able to purchase items and battle pass tiers

without confirmation screens on PC and console. If we added confirmation screens for

these platforms, it would bring additional clarity and provide more safeguards for all.”

On July 2, 2018, Epic’s Director of Player Support circulated another Player Support

Status Update that included a list of “Top Ticket Issues.” Number 5 on the list is:

“Accidental Purchase Claims – same as previously mentioned. Additional confirmation

screens with the ability to bypass with a 1-click option that you must explicitly setup the

first time could be a solution. [Player Support] recommends offering players both

options, similar to Amazon before setting up 1-click.”

On July 20, 2018, an Epic Community Coordinator asked if there were any plans to add a

confirmation step for in-game purchases, noting: “This is actually a huge complaints on

our side and could remove most of the ‘excuses’ about accidental purchase: ‘I wanted to

press Replay, my PS4 was in sleep mode’, etc. This is something I wanted to push

9

forward but didn’t have time to build a real case around, has this already been discussed

in the past?”

On October 10, 2018, the same Community Coordinator emailed Epic’s Lead of Online

Gameplay Systems “to check if anything is happening around this topic.” He further

stated: “We still have regular complaints that we are not asking for confirmation before

purchasing and that players have to use refund tickets or are out of tickets because of a

button push. It’s especially the case on controllers when getting the console out of sleep

or hitting the ‘replay’ option on emotes.”

On March 8, 2019, Epic’s Lead of Online Gameplay Systems recommended that Epic

add a confirmation button for in-game purchases. In support of this recommendation, he

noted, “I know I personally play on Switch and I am VERY careful when I am in the

shop to the extent I am a little paranoid of bumping the controller and I am spending free

v-bucks.”

In April 2019, the Community Coordinator noted that “[o]n social media the

confirmation button is highly requested, especially for PS4.” According to the email,

“some of [the complaints] refer to various issues, such as buying while in a loading

screen (I think pressing buttons during a loading screen and the game still taking the

command at the end of the loading screen), mistake made to preview styles (some players

reports the button to view style in the locker and in the shop are different), or simple

button press mistakes.”

36. Despite these repeated complaints and recommendations from customers and

employees, Epic continues to charge users for in-game items without their authorization. It only

started requiring an additional step (beyond pressing a single button) for one type of item (Battle

Passes) in or around June 2020 – three years after Epic began billing consumers for in-game

charges, and also after learning that it was under investigation by the FTC. For all other items

(i.e., Cosmetics and Llamas), it continues to charge users based on the press of a single button.

Epic Uses Dark Patterns to Deter Users from Cancelling or Requesting Refunds for V-

Bucks Charges

37. Epic has never allowed users to cancel or undo charges for Battle Passes or

Llamas and did not begin allowing users to cancel Cosmetics charges until June 2019. Even then,

Epic uses design tricks, sometimes referred to as “dark patterns,” to deter consumers from

cancelling or requesting refunds for unauthorized V-Bucks charges.

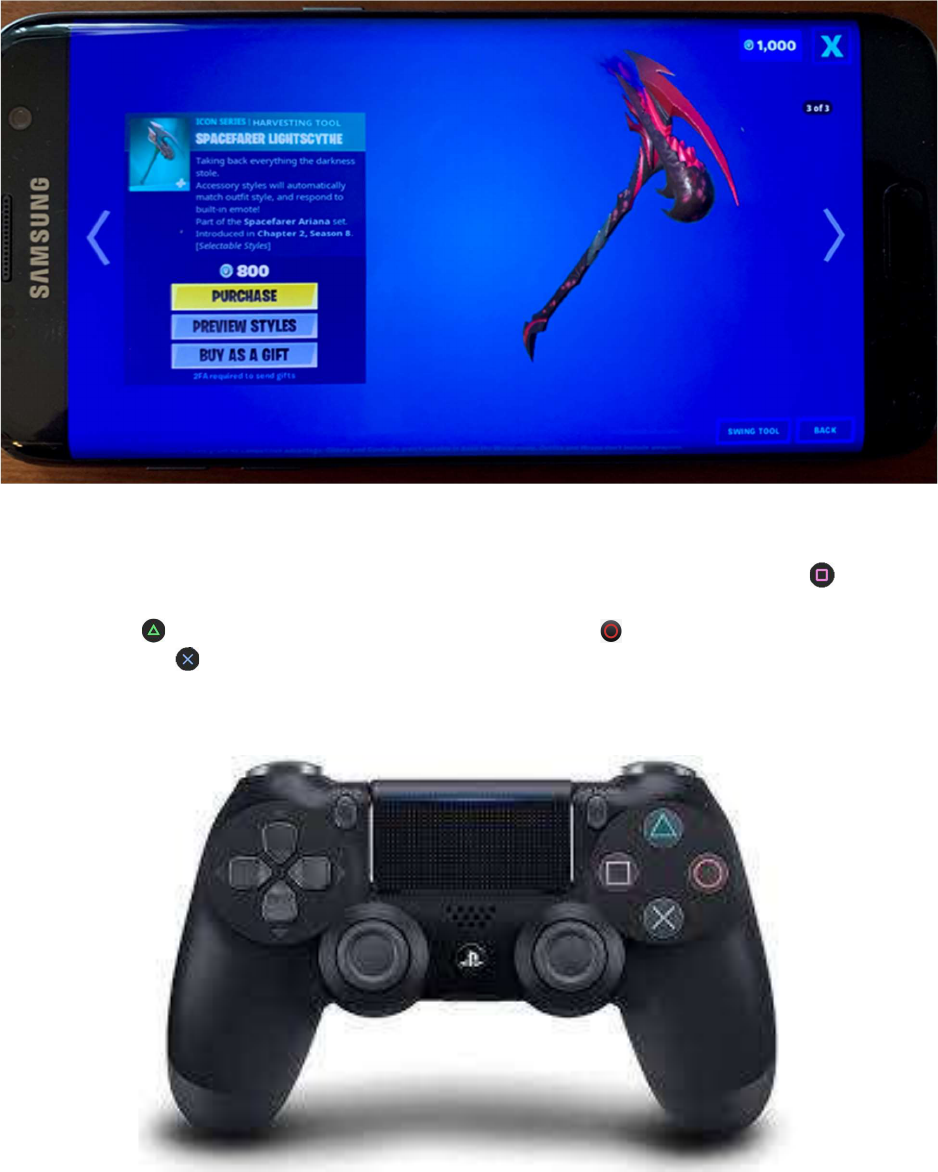

38. In June 2019, Epic began allowing users to cancel Cosmetics charges, but only for

a limited time and only if they remained on the purchase screen. Initially, an “Undo” button

appeared on the user’s screen in the same area as the “Get V-Bucks” button, as shown below.

10

39. However, after numerous players used the “Undo” button to cancel unwanted

charges – “‘I accidentally purchased an item I did not want’ was the number one ‘reason’ for

using the ‘Undo’ button[,]” according to an Epic customer survey – Epic took steps to reduce its

prominence. Specifically, as shown below, Epic changed the name of the button to “Cancel

Purchase,” reduced the size of the button, moved it to the bottom of the screen, and required

consumers to push and hold a button on their controller (even though Epic does not require

consumers to do so to purchase items in the first place).

11

40. After making these changes, Epic “observed a roughly 35% decline in the net

undo-rate (% of undo-eligible purchases that result in an undo that is not followed by a re-

purchase),” according to an email from a Senior Product Manager.

41. Consumers have complained that they did not see the option to cancel due to

Epic’s efforts to obscure it. For example, in September 2019, a parent emailed Epic Player

Support to complain about an unauthorized charge incurred while his 9-year-old was playing

Fortnite and to request a refund. After Player Support responded by explaining Epic’s refund

policy (discussed below), he responded: “I have already used my refund tokens, I used them

before you implemented the cancel purchase button. You know the button that I never saw any

big announcement about, the button that is small and unobtrusive, that because of your refund

tokens I didn’t know was there.”

42. Epic also imposes strict limitations on refunds. Epic does not refund charges for

Battle Passes or Llamas, and refunds Cosmetics charges only in some cases. Moreover, since

June 2018, Epic has restricted users to a lifetime maximum of three refunds per account. Epic

tracks users’ refunds by issuing them tokens when they create an account. Many consumers have

reported using all of their refund tokens and therefore not being able to obtain a refund for

unauthorized charges billed by Epic. Prior to June 2018, consumers could not request a refund

through the Fortnite app but had to complete a form on Epic’s website.

43. In addition, Epic deliberately requires consumers to find and navigate a difficult

and lengthy path to request a refund through the Fortnite app. To start, Epic hid the link to

submit a refund request under the “Settings” tab on the Fortnite app menu, far removed from the

purchase screen, even though requesting a refund is not a game or device setting. The Epic user

experience (“UX”) designer who helped design the refund request path reported that he put the

link there in an “attempt to obfuscate the existence of the feature” and that “not a single player

found this option in the most recent round of UX testing.” When the designer asked whether he

should make the feature easier to find, he was told by a superior, “it is perfect where it is at.”

44. Even if consumers locate the refund request path, Epic forces them to navigate

several unnecessary steps to submit the request. For example, Epic requires consumers to supply

a reason for their refund request (even though Epic permits account holders to use their three

lifetime refunds for any reason) and to confirm their intent to request a refund (even though Epic

does not require users to confirm their intent to purchase items in the first instance). The Epic

UX designer referred to this strategy of discouraging consumers from requesting refunds by

requiring consumers to take multiple unnecessary steps as “add[ing] friction for friction’s sake.”

12

Epic Denies Consumers Access to Their Fortnite Accounts for Disputing Epic’s

Unauthorized Charges

45. When consumers incur fraudulent or unauthorized charges to their credit cards,

they have the right to dispute the charges through their financial institutions and request that the

money be charged back to the company that initiated the charge. See Fair Credit Billing Act,

15 U.S.C. § 1666, et seq. This process commonly is referred to as a “chargeback.”

46. Since July 2017, Epic has received tens of thousands of chargebacks, totaling

millions of dollars. In fact, Epic received so many chargebacks from consumers that Visa and

Mastercard placed Epic in their respective chargeback monitoring programs, threatening Epic’s

ability to process consumer payments through the networks going forward.

47. Since at least February 2018, when consumers have disputed Epic’s unauthorized

charges with their credit card companies and asked that they be charged back, Epic has

deactivated their Fortnite accounts regardless of the reason for the dispute or whether it was

upheld.

48. Consumers’ Fortnite accounts store all Fortnite content they have ever purchased.

Thus, consumers whose accounts Epic has banned have not only lost access to the Fortnite

content that was the subject of the billing dispute, but also all content they have ever purchased

on that account. Epic has not refunded consumers for this previously paid-for content, which for

some consumers has totaled hundreds or even thousands of dollars. Only if consumers have

contacted Epic, and Epic has determined that there is no risk of fraud, has Epic agreed to

reactivate consumers’ accounts. Even then, they have only agreed to do so one time. If

consumers dispute another fraudulent or unauthorized charge, Epic permanently bans them

without refunding them for their paid-for content.

49. Consumers have been unaware of Epic’s practice of denying them access to paid-

for content for initiating chargebacks. To the extent Epic mentions depriving consumers of

content, it buries such information in its Terms of Service, End User License Agreement, or on

its website, and even then, makes no mention of depriving access to paid-for content for

disputing unauthorized charges with their bank or credit card provider.

50. Epic has received at least thousands of complaints from consumers whose

accounts were banned due to chargebacks.

51. Despite these complaints, Epic continues to deactivate the accounts of consumers

who dispute Epic’s unauthorized charges with their credit card companies.

52. Based on the facts and violations of law alleged in this Complaint, the FTC has

reason to believe that Respondent is violating or is about to violate laws enforced by the

Commission.

VIOLATIONS OF THE FTC ACT

53. Section 5(a) of the FTC Act, 15 U.S.C. § 45(a), prohibits “unfair or deceptive acts

or practices in or affecting commerce.”

54. Acts or practices are unfair under Section 5 of the FTC Act if they cause or are

likely to cause substantial injury to consumers that consumers cannot reasonably avoid

themselves and that is not outweighed by countervailing benefits to consumers or competition.

15 U.S.C. § 45(n).

Count I

Unfair Billing

55. In numerous instances, Respondent has charged consumers without having

obtained consumers’ express informed consent.

56. Respondent’s actions as described in Paragraph 55 have caused or are likely to

cause substantial injury to consumers that consumers cannot reasonably avoid themselves and

that is not outweighed by countervailing benefits to consumers or competition.

57. Therefore, Respondent’s acts or practices as set forth in Paragraph 55 constitute

unfair acts or practices in violation of Section 5 of the FTC Act, 15 U.S.C. § 45(a) and (n).

Count II

Unfair Denial of Account Access

58. In numerous instances, Respondent has denied consumers access to their Fortnite

accounts for disputing unauthorized charges.

59. Respondent’s actions as described in Paragraph 58 have caused or are likely to

cause substantial injury to consumers that consumers cannot reasonably avoid themselves and

that is not outweighed by countervailing benefits to consumers or competition.

60. Therefore, Respondent’s acts or practices as set forth in Paragraph 58 constitute

unfair acts or practices in violation of Section 5 of the FTC Act, 15 U.S.C. § 45(a) and (n).

13

14

By the Commission.

April J. Tabor

Secretary

SEAL:

61. The acts and practices of Respondent as alleged in this Complaint constitute

unfair or deceptive acts or practices, in or affecting commerce, in violation of Section 5(a) of the

Federal Trade Commission Act.

THEREFORE, the Federal Trade Commission this 13th day of March, 2023, has issued this

Complaint against Respondent.

EXHIBIT 1

EXHIBIT 2

192-3203

UNITED STATES OF AMERICA

BEFORE THE FEDERAL TRADE COMMISSION

COMMISSIONERS: Lina M. Khan, Chair

Rebecca Kelly Slaughter

Christine S. Wilson

Alvaro M. Bedoya

In the Matter of

EPIC GAMES, INC., a corporation.

DECISION AND ORDER

DOCKET NO. C- 4790

DECISION

The Federal Trade Commission (“Commission”) initiated an investigation of certain acts and

practices of the Respondent named in the caption. The Commission’s Bureau of Consumer

Protection (“BCP”) prepared and furnished to Respondent a draft Complaint. BCP proposed to

present the draft Complaint to the Commission for its consideration. If issued by the

Commission, the draft Complaint would charge the Respondent with violations of the Federal

Trade Commission Act.

Respondent and BCP thereafter executed an Agreement Containing Consent Order (“Consent

Agreement”). The Consent Agreement includes: 1) statements by Respondent that it neither

admits nor denies any of the allegations in the Complaint, except as specifically stated in this

Decision and Order, and that only for purposes of this action, it admits the facts necessary to

establish jurisdiction; and 2) waivers and other provisions as required by the Commission’s

Rules.

The Commission considered the matter and determined that it had reason to believe that

Respondent has violated the Federal Trade Commission Act, and that a Complaint should issue

stating its charges in that respect. The Commission accepted the executed Consent Agreement

and placed it on the public record for a period of 30 days for the receipt and consideration of

public comments. The Commission duly considered any comments received from interested

persons pursuant to Section 2.34 of its Rules, 16 C.F.R. § 2.34. Now, in further conformity with

the procedure prescribed in Rule 2.34, the Commission issues its Complaint, makes the

following Findings, and issues the following Order:

2

Findings

1. The Respondent is Epic Games, Inc., a Maryland corporation with its principal office or

place of business at 620 Crossroads Blvd., Cary, North Carolina 27518.

2. The Commission has jurisdiction over the subject matter of this proceeding and over the

Respondent, and the proceeding is in the public interest.

ORDER

Definitions

For purposes of this Order, the following definitions apply:

A. “Account Holder” means an individual or entity that is responsible for paying for

Charges associated with an account to which Respondent may bill Charges.

B. “Application” means any software application that can be installed on a computing

device, including a personal computer, mobile device, or video game console.

C. “Application Activity” or “Application Activities” means any user conduct within an

Application, including the acquisition of currency, goods, services, or other Applications.

D. “Charge” means a charge associated with an Application Activity billed by Respondent.

E. “Clear and conspicuous” means that a required disclosure is difficult to miss (i.e., easily

noticeable) and easily understandable by ordinary consumers, including in all of the

following ways:

1. In any communication that is solely visual or solely audible, the disclosure must be

made through the same means through which the communication is presented. In any

communication made through both visual and audible means, such as a television

advertisement, the disclosure must be presented simultaneously in both the visual and

audible portions of the communication even if the representation requiring the

disclosure (“triggering representation”) is made through only one means.

2. A visual disclosure, by its size, contrast, location, the length of time it appears, and

other characteristics, must stand out from any accompanying text or other visual

elements so that it is easily noticed, read, and understood.

3. An audible disclosure, including by telephone or streaming video, must be delivered

in a volume, speed, and cadence sufficient for ordinary consumers to easily hear and

understand it.

4. In any communication using an interactive electronic medium, such as the Internet or

software, the disclosure must be unavoidable.

3

5. The disclosure must use diction and syntax understandable to ordinary consumers and

must appear in each language in which the triggering representation appears.

6. The disclosure must comply with these requirements in each medium through which

it is received, including all electronic devices and face-to-face communications.

7. The disclosure must not be contradicted or mitigated by, or inconsistent with,

anything else in the communication.

8. When the representation or sales practice targets a specific audience, such as children,

the elderly, or the terminally ill, “ordinary consumers” includes reasonable members

of that group.

F. “Express, Informed Consent” means, upon being presented with options to provide or

withhold consent, an affirmative act communicating informed authorization of a Charge,

made prior to and proximate to an Application Activity for which there is a Charge and to

Respondent’s Clear and Conspicuous disclosure of all material information related to the

billing, including:

1. If consent is sought for a specific Charge: (a) the Application Activity associated with

the Charge; (b) the specific amount of the Charge; and (c) the account that will be

billed for the Charge; or

2. If consent is sought for potential future Charges: (a) the scope of the Charges for

which consent is sought, including the duration and Applications to which consent

applies; (b) the account that will be billed for the Charge; and (c) method(s) through

which the Account Holder can revoke or otherwise modify the scope of consent on

the device, including an immediate means to access the method(s).

Provided that the solicitation of the “affirmative act” and the disclosure of the

information in F.1 and F.2 must be reasonably calculated to ensure that the person

providing Express, Informed Consent is the Account Holder.

Provided also that if Respondent obtains Express, Informed Consent to potential future

Charges as set forth in definition F.2 above, it must do so a minimum of once per device.

Provided also that Express, Informed Consent may not be obtained through a user

interface that has the effect of subverting or impairing user autonomy, decision-making,

or choice.

4

Provisions

I.

IT IS ORDERED that Respondent and its officers, agents, and employees, and all other

persons in active concert or participation with any of them, who receive actual notice of this

Order, whether acting directly or indirectly, are restrained and enjoined for the term of this Order

from billing an Account Holder for any Charge without having obtained Express, Informed

Consent for the Charge. If Respondent seeks and obtains Express, Informed Consent to billing

potential future Charges (other than future royalty payments owed by the user based on revenue

the user derives from use of an Application), Respondent must provide the Account Holder with

a simple mechanism to revoke consent at any time. Such mechanism must not be difficult,

costly, confusing, or time consuming, and must be at least as simple as the mechanism the

consumer used to initiate the Charge(s).

II.

IT IS FURTHER ORDERED that Respondent and its officers, agents, employees, and

attorneys, and all other persons in active concert or participation with any of them, who receive

actual notice of this Order, whether acting directly or indirectly, in connection with the

advertising, marketing, promoting, offering for sale, or selling of any goods or services, are

permanently restrained and enjoined from denying, temporarily or permanently, a consumer’s

access to or use of his or her account, including any paid-for goods or services, for reasons that

include the consumer’s dispute of a Charge.

III. Monetary Relief

IT IS FURTHER ORDERED that:

A. Respondent must pay to the Commission $245,000,000, which its undersigned counsel

holds in escrow for no purpose other than payment to the Commission.

B. Such payment must be made within 8 days of the effective date of this Order by

electronic fund transfer in accordance with instructions provided by a representative of

the Commission.

IV. Additional Monetary Provisions

IT IS FURTHER ORDERED that:

A. Respondent relinquishes dominion and all legal and equitable right, title, and interest in

all assets transferred pursuant to this Order and may not seek the return of any assets.

B. The facts alleged in the Complaint will be taken as true, without further proof, in any

subsequent civil litigation by or on behalf of the Commission to enforce its rights to any

payment pursuant to this Order, such as a nondischargeability complaint in any

5

bankruptcy case.

C. The facts alleged in the Complaint establish all elements necessary to sustain an action by

or on behalf of the Commission pursuant to Section 523(a)(2)(A) of the Bankruptcy

Code, 11 U.S.C. § 523(a)(2)(A), and this Order will have collateral estoppel effect for

such purposes.

D. All money paid to the Commission pursuant to this Order may be deposited into a fund

administered by the Commission or its designee to be used for relief, including consumer

redress and any attendant expenses for the administration of any redress fund. If a

representative of the Commission decides that direct redress to consumers is wholly or

partially impracticable or money remains after redress is completed, the Commission may

apply any remaining money for such other relief (including consumer information

remedies) as it determines to be reasonably related to Respondent’s practices alleged in

the Complaint. Any money not used is to be deposited to the U.S. Treasury. Respondent

has no right to challenge any activities pursuant to this Provision.

E. In the event of default on any obligation to make payment under this Order, interest,

computed as if pursuant to 28 U.S.C. § 1961(a), shall accrue from the date of default to

the date of payment. In the event such default continues for 10 days beyond the date that

payment is due, the entire amount will immediately become due and payable.

F. Each day of nonpayment is a violation through continuing failure to obey or neglect to

obey a final order of the Commission and thus will be deemed a separate offense and

violation for which a civil penalty shall accrue.

G. Respondent acknowledges that its Taxpayer Identification Number (Social Security or

Employer Identification Number), which Respondent has previously submitted to the

Commission, may be used for collecting and reporting on any delinquent amount arising

out of this Order, in accordance with 31 U.S.C. § 7701.

V. Customer Information

IT IS FURTHER ORDERED that Respondent must directly or indirectly provide sufficient

customer information to enable the Commission to efficiently administer consumer redress to

Account Holders to whom Respondent billed a Charge without Express, Informed Consent, and

Account Holders whom Respondent denied access to paid-for goods or services for disputing

any Charge. If a representative of the Commission requests in writing any information related to

redress, Respondent must provide it, in the form prescribed by the Commission representative,

within 14 days.

VI. Acknowledgments of the Order

IT IS FURTHER ORDERED that Respondent obtains acknowledgments of receipt of this

Order:

6

A. Respondent, within 10 days after the effective date

of this Order, must submit to the

Commission an acknowledgment of receipt of this Order sworn under penalty of perjury.

B. For 20 years after the issuance date of this Order, Respondent must deliver a copy of this

Order to: (1) all principals, officers, directors, and LLC managers and members; (2) all

employees having managerial responsibilities for conduct related to the subject matter of

the Order and all agents and representatives who participate in conduct related to the

subject matter of the Order; and (3) any business entity resulting from any change in

structure as set forth in the Provision titled Compliance Report and Notices. Delivery

must occur within 10 days after the effective date of this Order for current personnel. For

all others, delivery must occur within 10 days of when they assume their responsibilities.

C. From each individual or entity to which Respondent delivered a copy of this Order,

Respondent must obtain, within 30 days, a signed and dated acknowledgment of receipt

of this Order.

VII. Compliance Report and Notices

IT IS FURTHER ORDERED that Respondent make timely submissions to the

Commission:

A. One year after the issuance date of this Order, Respondent must submit a compliance

report, sworn under penalty of perjury, in which:

1. Respondent must: (a) identify the primary physical, postal, and email address and

telephone number, as designated points of contact, which representatives of the

Commission, may use to communicate with Respondent; (b) identify all of

Respondent’s businesses by all of their names, telephone numbers, and physical,

postal, email, and Internet addresses; (c) describe the activities of each business,

including the goods and services offered, purchase flows, billing practices; (d)

describe in detail whether and how Respondent is in compliance with each Provision

of this Order, including a discussion of all material changes Respondent made to

comply with the Order; and (e) provide a copy of each Acknowledgment of the Order

obtained pursuant to this Order, unless previously submitted to the Commission.

B. For 10 years after the issuance date of this Order, Respondent must submit a compliance

notice, sworn under penalty of perjury, within 14 days of any change in the following:

1. Respondent must submit notice of any change in: (a) any designated point of contact;

or (b) the structure of Respondent or any entity that Respondent has any ownership

interest in or controls directly or indirectly that may affect compliance obligations

arising under this Order, including: creation, merger, sale, or dissolution of the entity

or any subsidiary, parent, or affiliate that engages in any acts or practices subject to

this Order.

7

C. Respondent must submit notice of the filing of any bankruptcy petition, insolvency

proceeding, or similar proceeding by or against Respondent within 14 days of its filing.

D. Any submission to the Commission required by this Order to be sworn under penalty of

perjury must be true and accurate and comply with 28 U.S.C. § 1746, such as by

concluding: “I declare under penalty of perjury under the laws of the United States of

America that the foregoing is true and correct. Executed on: _____” and supplying the

date, signatory’s full name, title (if applicable), and signature.

E. Unless otherwise directed by a Commission representative in writing, all submissions to

the Commission pursuant to this Order must be emailed to [email protected] or sent by

overnight courier (not the U.S. Postal Service) to: Associate Director for Enforcement,

Bureau of Consumer Protection, Federal Trade Commission, 600 Pennsylvania Avenue

NW, Washington, DC 20580. The subject line must begin: In re Epic Games, Inc.,

[C or D docket number].

VIII. Recordkeeping

IT IS FURTHER ORDERED that Respondent must create certain records for 10 years and

retain each such record for 5 years. Specifically, Respondent, for any business that Respondent is

a majority owner or controls directly or indirectly, must create and retain the following records:

A. accounting records showing the revenues from all goods or services sold, the costs

incurred in generating those revenues, and resulting net profit or loss;

B. personnel records showing, for each person providing services in relation to any aspect of

the Order, whether as an employee or otherwise, that person’s: name; addresses;

telephone numbers; job title or position; dates of service; and (if applicable) the reason

for termination;

C. copies or records of all consumer complaints and refund requests concerning the subject

matter of the Order, whether received directly or through any domestic government

regulatory authority;

D. records of any market, behavioral, or psychological research, or user or customer testing

performed by or at the direction of Respondent, including any A/B or multivariate

testing, copy testing, surveys, focus groups, customer interviews, clickstream analysis,

eye or mouse tracking studies, heat maps, or session replays or recordings;

E. for 5 years from the date received, copies of all subpoenas and other communications

with domestic law enforcement, if such communication relate to Respondent’s

compliance with this Order;

F. for 5 years from the date created or received, all custodial records for individuals with

managerial responsibility for digital purchasing and user interface; and

8

G. all records necessary to demonstrate full compliance with each provision of this Order,

including all submissions to the Commission.

IX. Compliance Monitoring

IT IS FURTHER ORDERED that, for the purpose of monitoring Respondent’s

compliance with this Order:

A. Within 10 days of receipt of a written request from a representative of the Commission,

Respondent must: submit additional compliance reports or other requested information,

which must be sworn under penalty of perjury, and produce records for inspection and

copying.

B. For matters concerning this Order, representatives of the Commission are authorized to

communicate directly with Respondent. Respondent must permit representatives of the

Commission to interview anyone affiliated with Respondent who has agreed to such an

interview. The interviewee may have counsel present.

C. The Commission may use all other lawful means, including posing through its

representatives as consumers, suppliers, or other individuals or entities, to Respondent or

any individual or entity affiliated with Respondent, without the necessity of identification

or prior notice. Nothing in this Order limits the Commission’s lawful use of compulsory

process, pursuant to Sections 9 and 20 of the FTC Act, 15 U.S.C. §§ 49, 57b-1.

X. Order Effective Dates

IT IS FURTHER ORDERED that this Order is final and effective upon the date of its

publication on the Commission’s website (ftc.gov) as a final order. This Order will terminate 20

years from the date of its issuance (which date may be stated at the end of this Order, near the

Commission’s seal), or 20 years from the most recent date that the United States or the

Commission files a complaint (with or without an accompanying settlement) in federal court

alleging any violation of this Order, whichever comes later; provided, however, that the filing of

such a complaint will not affect the duration of:

A. Any Provision in this Order that terminates in less than 20 years; and

B. This Order if such complaint is filed after the Order has terminated pursuant to this

Provision.

Provided, further, that if such complaint is dismissed or a federal court rules that the Respondent

did not violate any provision of the Order, and the dismissal or ruling is either not appealed or

upheld on appeal, then the Order will terminate according to this Provision as though the

complaint had never been filed, except that the Order will not terminate between the date such

complaint is filed and the later of the deadline for appealing such dismissal or ruling and the date

9

such dismissal or ruling is upheld on appeal.

By the Commission.

April J. Tabor

Secretary

SEAL:

ISSUED: March 13, 2023